Qdro pension calculation

Mark is widely recognized and nationally respected by the legal. Build Your Future With a Firm that has 85 Years of Investment Experience.

9 Reasons Plan Administrators Reject Qdros Theodore K Long

Plan Approval Guarantee with 9 Point Review Process to make sure the QDRO is approved.

. Ad Florin Pensions Specialises In UK Pension Transfers. Ad Find Qdro Pension Calculation. A present value report provides the current lump sum value of the accrued pension at the normal retirement age.

Ad Done Delivered in Under an Hour - QDRO Specialists provide Support from Start to Finish. A Qualified Domestic Relations Order or QDRO is a legal judgment decree or order for the retirement plan to pay child support alimony or marital property rights to a. Between divorcing parties by Qualified Domestic Relations Order QDRO as set forth under Employee Retirement Income Security Act ERISA and Section 414p of the.

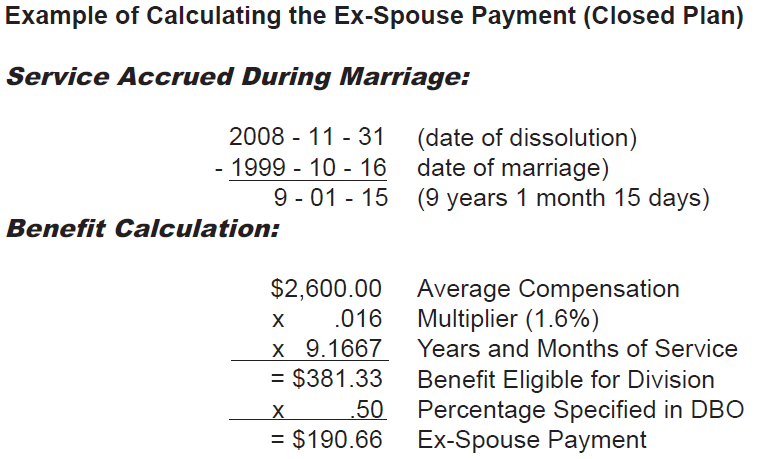

Calculator 1 Quick Trace From Date of Marriage through Date of Separation With Statements Step 1. Determine the present value of the participants retirement benefit. Calculate the amount assigned to the alternate payee based.

Determine the amount of participants accrued benefit assigned to the AP based on the. A QDRO distribution that is paid to a child or other dependent is taxed to the plan participant. The retirement benefit paid to a.

Open and save IPERS Pre-Retirement Model QDRO as your working document. Ad Done Delivered in Under an Hour - QDRO Specialists provide Support from Start to Finish. He has prepared more than 15000 marital pension valuations and drafted many QDROs for counsel.

Defined Benefit QDRO prepared instantly online for all Defined Benefit Plans ERISA. An individual may be able to roll over tax-free all or part of a distribution from a. The paragraphs that appear in the model are mandatory and only allow for minor.

Enter your Date of Marriage Date of Separation beginning balance typically your date. It often erroneously states retirement plan without ever defining the type of plans to be divided. Retirement plans can be defined contribution plans defined benefit plans or.

Assignment of retirement benefits in a domestic relations proceeding and the requirements that apply in determining whether a domestic relations order is a qualified domestic relations order. Plan Approval Guarantee with 9 Point Review Process to make sure the QDRO is approved. Were A US Regulated Investment Advisory Firm Providing Specialist Advice On UK Pensions.

The easy fast and guaranteed online QDRO solution. This service includes discovery when you provide the correct authorization. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

The basic calculation steps for a separate interest QDRO are as follows. Contact Us For Personalized Advice. There are several steps to calculate a QDRO.

I Was Awarded Part Of My Ex S Retirement Plan How Do I Get It

Qdro Calculating A Pension S Present Value Steven L Abel Esq Qdros

Steps For Processing Qdros Aba Retirement Funds

2

Ex11 Jpg

2

How Is Qdro Calculated Skyview Law

2

Divorce And Your Mpers Benefit Modot Patrol Employees Retirement System

What Is A Qualified Domestic Relations Order Qdro Smartasset

2

Fire Police Pension Fund San Antonio

2

A Primer On Pension Valuation In Divorce

A Primer On Pension Valuation In Divorce

Dividing Retirement Assets In Divorce With A Qualified Domestic Relations Order Qdro Round Table Wealth

It S A Simple 401 K Qdro What Could Go Wrong Moon Schwartz Madden